Stealth Bear Market?

By John Del Vecchio and Brad Lamensdorf

Surprise!

Despite record highs for equity indexes, we are in a stealth bear market in the Nasdaq.

As the chart below shows, while the Nasdaq pushes higher, the percentage of stocks above their 200-day moving average is plunging. As a result, a massive divergence if forming between the index and the stocks that comprise the index.

However, the problem is not that the percentage of stocks above their 200-day moving average are falling sharply. The problem is that many of these stocks are already in bear market territory.

Look at this.

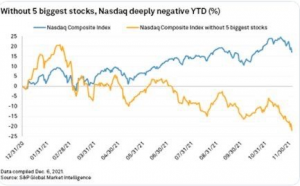

Without the five biggest stocks, the Nasdaq is in the red on the year. The market is down over 20%.

By the time the market gets around the punishing the most heavily weighted stocks in the index, a lot of damage will be done. A lot of damage has already been done. It could get much worse from here.

It may be time to stock up on hedges for the holidays once again!

DISCLOSURE: LAMENSDORF MARKET TIMING REPORT

Lamensdorf Market Timing Report is a publication intended to give analytical research to the investment community. Lamensdorf Market Timing Report is not rendering investment advice based on investment portfolios and is not registered as an investment advisor in any jurisdiction. Information included in this report is derived from many sources believed to be reliable but no representation is made that it is accurate or complete, or that errors, if discovered, will be corrected. The authors of this report have not audited the financial statements of the companies discussed and do not represent that they are serving as independent public accountants with respect to them. They have not audited the statements and therefore do not express an opinion on them. The authors have also not conducted a thorough review of the financial statements as defined by standards established by the AICPA.

This report is not intended, and shall not constitute, and nothing herein should be construed as, an offer to sell or a solicitation of an offer to buy any securities referred to in this report, or a “buy” or “sell” recommendation. Rather, this research is intended to identify issues portfolio managers should be aware of for them to assess their own opinion of positive or negative potential. The LMTR newsletter is NOT affiliated with any ETF’s. Active Alts is affiliated with Lamensdorf Market Timing Report. While LMTR uses charts from SentimenTrader, they do not have a financial arrangement with SentimenTrader Past performance is not indicative of future results.