Unprecedented

Rarely do we see anything new in financial markets.

While markets evolve, human nature does not. The same extremes occur over and over again.

Those extremes are driven by fear and greed.

Fear and greed are powerful emotions that cloud our better judgment.

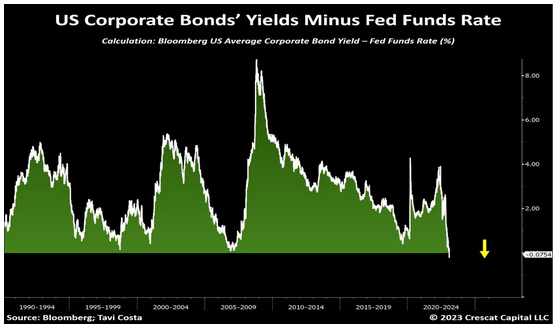

However, there is something new that has developed in 2023. Check out this chart.

Corporate bonds are yielding less than the Fed Funds Rate.

About 7.5 basis points, to be exact.

That tells us we live in a Bizzaro Superman world where everything is upside down, and nothing makes sense.

Why would you earn less to take more risk than a risk-free short-term rate?

It’s unprecedented.

While the recent run-up in stocks in 2023 could have signaled the end of the bear market, we are doubtful because of this chart.

Markets do not bottom when spreads are this tight.

Markets bottom after spreads have blown out.

Spreads are far from having blown out. Take a look at this chart below.

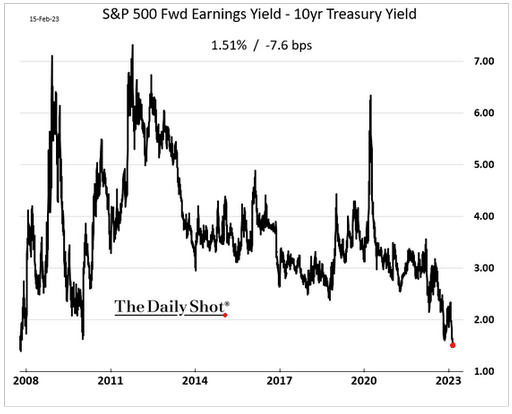

The chart shows the forward earnings yield on the S&P 500 minus the 10-year Treasury Yield.

We are right back to where we were in 2008.

We all know how that horror movie ended.

Lots of blood and guts.

Also, 2011 had a significant market scare, and this relationship was signaling trouble about six months ahead of time.

Right now, you’re taking a lot of relative risks owning aggressive risk assets.

It might work out, or…

It’s time to tighten stops and add to hedges.

To learn more about how these indicators can help manage risk in your portfolio, book a call with Brad. You may book a call here.

DISCLOSURE: LAMENSDORF MARKET TIMING REPORT

Lamensdorf Market Timing Report is a publication intended to give analytical research to the investment community. Lamensdorf Market Timing Report is not rendering investment advice based on investment portfolios and is not registered as an investment advisor in any jurisdiction. Information included in this report is derived from many sources believed to be reliable but no representation is made that it is accurate or complete, or that errors, if discovered, will be corrected. The authors of this report have not audited the financial statements of the companies discussed and do not represent that they are serving as independent public accountants with respect to them. They have not audited the statements and therefore do not express an opinion on them. The authors have also not conducted a thorough review of the financial statements as defined by standards established by the AICPA.

This report is not intended, and shall not constitute, and nothing herein should be construed as, an offer to sell or a solicitation of an offer to buy any securities referred to in this report, or a “buy” or “sell” recommendation. Rather, this research is intended to identify issues portfolio managers should be aware of for them to assess their own opinion of positive or negative potential. The LMTR newsletter is NOT affiliated with any ETF’s. Active Alts is affiliated with Lamensdorf Market Timing Report. While LMTR uses charts from SentimenTrader, they do not have a financial arrangement with SentimenTrader Past performance is not indicative of future results.