Just How Stretched is the Consumer?

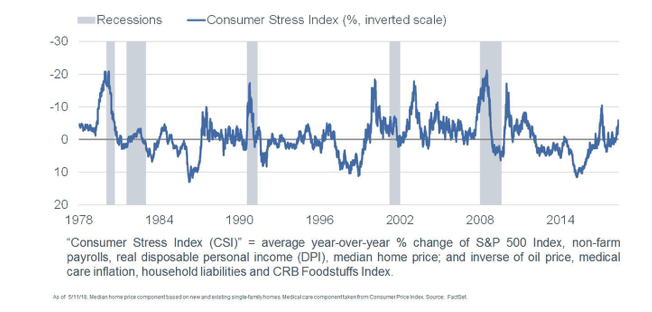

Liz Ann Sonders, Chief Strategist for Charles Schwab, has created her own formula to determine just how much stress the consumer is feeling. Clearly, since 2014 stress has increased sharply. But, this comes at a time when consumer confidence is at highs.

In addition, recessions appear to occur at levels above zero on the chart. Currently, we are above those levels.

The great thing about Sonders’ formula is it factors in expenses that hit us all in the real world. Things like food and energy costs the government typically downplays. My energy costs have gone up and I can clearly feel that. I also just received an increase in my healthcare costs starting next month. That money has to come from somewhere! If it comes out of discretionary spending, then the local coffee shop and grocery store will start to feel the pain. The recessions form.

There’s one factor clearly stressing out the consumer. Student loan debt. And, this might understate the pain an entire generation of Americans are feeling. While consumer confidence is at highs, 44 million Americans have $1.4 trillion in student loan debt. That compares to $640 billion during the crisis of 2008. In addition, home ownership among has fallen from 32% in 2007 to 21% in 2016. The weight of this debt is crushing.

If consumer confidence is high but consumers are also stressed, then what gives? Well, sometimes people say one thing and do another. I would always take government statistics with a grain of salt. Debt levels aren’t going away and incomes aren’t growing.

The next recession is likely to be a doozy!