Why Stock Market Could Move Higher for Remainder of 2018

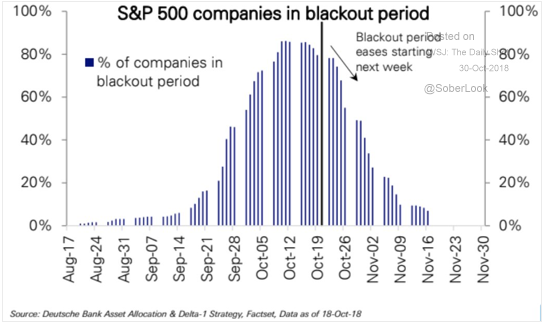

Although important technical and economic factors make us extremely cautious about the equity markets longer term, we’re looking at some shorter-term indicators that tell us the markets could experience profitable upward bounces during the rest of 2018. For one thing, as illustrated by the second chart below, most public companies can once again buy back their own stock after emerging from blackout periods that suspend buybacks before quarterly earnings announcements. Indeed, the fact they couldn’t buy during September and October may have exacerbated the recent sharp market declines.

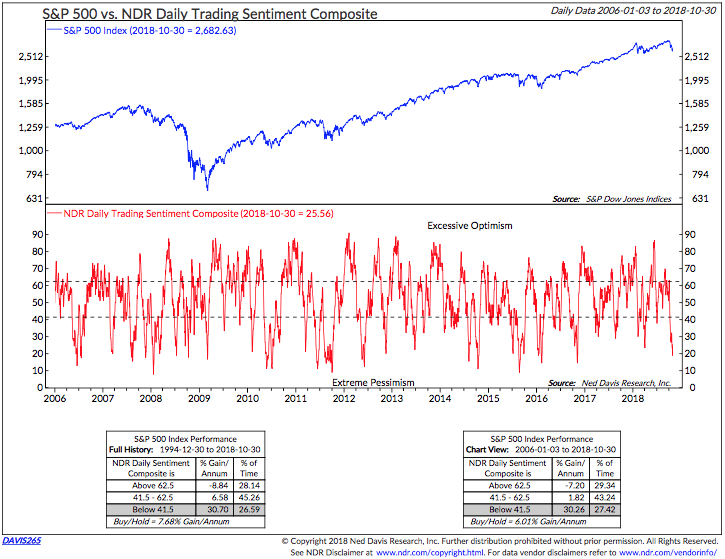

Another positive is that the Ned Davis short-term sentiment indicator is at only 20% bullish, the lowest level of the year. That means there’s a huge amount of bearish sentiment out there. And that’s positive news from a contrarian point of view since historically investors are wrong about market direction.

More good news for the remainder of 2018 is that a lot of mutual funds and the like subject to the 1940 investment company are done with the tax selling of the last two months that helped depress the markets. So that adds even more liquidity for upward market momentum this year as these investment companies initiate buying programs to maximize annual returns after flat to downward performance for the first 10 months of the year.