The Good Times are Rolling but the Market is Climaxing

By John Del Vecchio and Brad Lamensdorf

Buying climaxes are exploding!

This is bearish for the market.

A buying climax is when a stock makes a 52-week high but closes down for the week.

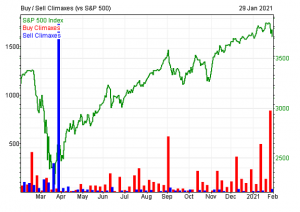

Take a look at the chart:

The red bar represents buying climaxing, and the blue bar is selling climaxes. As the chart shows, today’s situation is 180 degrees from where buying and selling pressure were near the COVID lows. Back in late March, massive selling climaxes occurred Right at the bottom!

Today, buying climaxes are exploding. These stocks are hitting new highs but closing down. As a result, those moves higher are running out of steam. The distribution of stock is increasing.

This is a bearish sign for the market.

This is another reason to starting planning hedges accordingly.

The Active Alts SentimenTrader Long / Short Strategy uses dozens of proprietary indicators, including buying and selling pressure, to adjust exposure based on market risks. SentimenTrader is a leading research firm with thousands of clients in over 50 countries around the world.

DISCLOSURE: LAMENSDORF MARKET TIMING REPORT

Lamensdorf Market Timing Report is a publication intended to give analytical research to the investment community. Lamensdorf Market Timing Report is not rendering investment advice based on investment portfolios and is not registered as an investment advisor in any jurisdiction. Information included in this report is derived from many sources believed to be reliable but no representation is made that it is accurate or complete, or that errors, if discovered, will be corrected. The authors of this report have not audited the financial statements of the companies discussed and do not represent that they are serving as independent public accountants with respect to them. They have not audited the statements and therefore do not express an opinion on them. The authors have also not conducted a thorough review of the financial statements as defined by standards established by the AICPA.

This report is not intended, and shall not constitute, and nothing herein should be construed as, an offer to sell or a solicitation of an offer to buy any securities referred to in this report, or a “buy” or “sell” recommendation. Rather, this research is intended to identify issues portfolio managers should be aware of for them to assess their own opinion of positive or negative potential. The LMTR newsletter is NOT affiliated with any ETF’s. Active Alts is affiliated with Lamensdorf Market Timing Report. While LMTR uses charts from SentimenTrader, they do not have a financial arrangement with SentimenTrader Past performance is not indicative of future results.