Is this Sector Pointing to Market Troubles Over the Next 6 Months?

By John Del Vecchio

In Brad’s most recent podcast, which you can listen to here, he talks about how investors need to pay attention to the financial sector as a clue to what might occur in the broader markets.

For example, in 2008, as we were headed to one of the biggest crisis of all-time, banks were weak all year. They were signaling trouble to come. And, boy did it come. While a few investors saw the storm on the horizon most folks had their head in the sand. Just months before the epic collapse, the talking heads on TV were praising the goldilocks economy. It was neither too hot or too cold. Government officials were promoting the idea of green shoots in the economy.

We all know how that turned out.

Is it Déjà vu all over again with the banks?

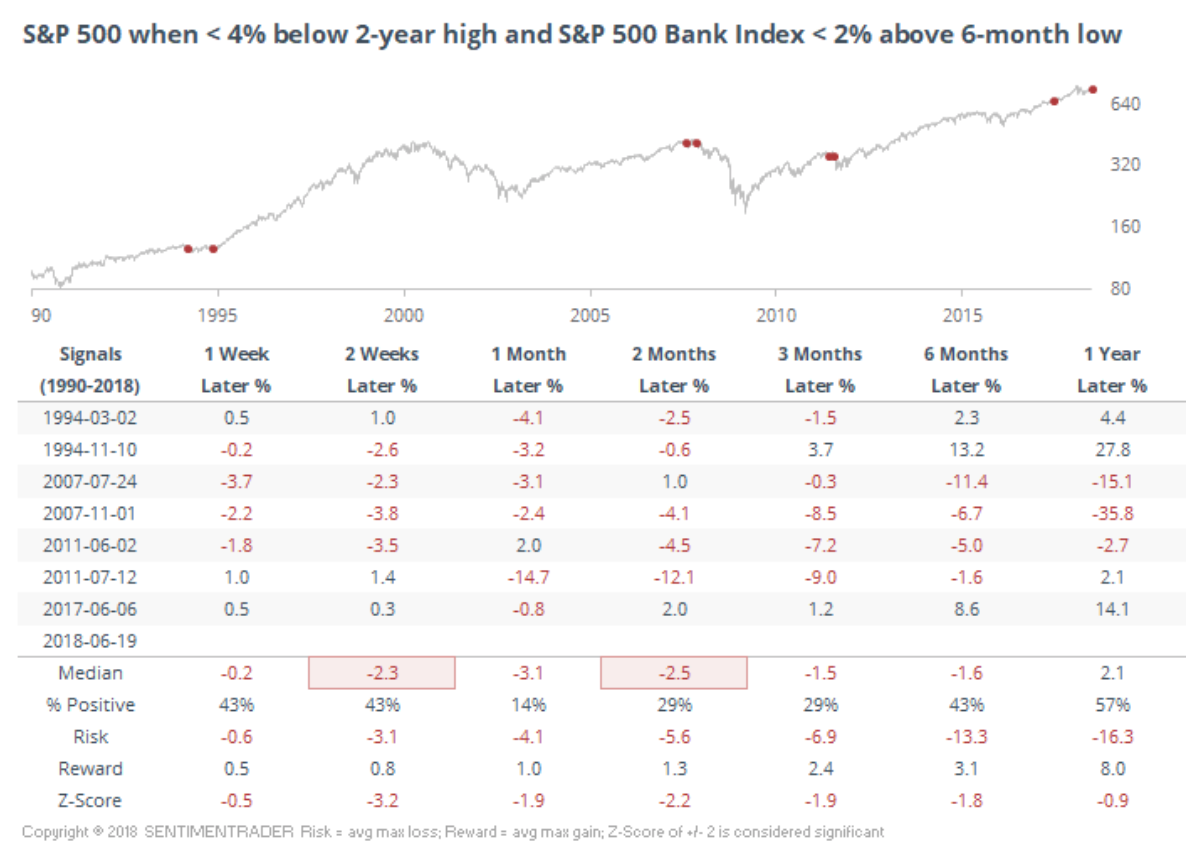

Take a look at the chart below:

The S&P 500 is marching toward fresh highs. Meanwhile, banks have reversed course and are near intermediate lows. Historically, this has been a warning sign. Three months later, after these conditions have been met, stocks are mostly lower. At worst, we might expect them to be flattish. The same holds true for six months after banks have historically led the way lower.

The record is mixed a year out. Of course, by then the powers to be have had time to react and adjust policy to restore confidence in the markets.

So, where are we today? It’s been on of the best capitalization periods for banks in the U.S. Regulations are also being watered down to the benefit of many financial institutions.

So, this question begs why are banks starting to perform so poorly? What are they signaling about the broader markets and economy?

If history is any guide, we will likely find out very soon.