A Horror Movie for Shorts Will End in Blood for Careless Investors

By John Del Vecchio and Brad Lamensdorf

The headlines are filled with talk of massive short squeezes and huge moves in companies of dubious quality.

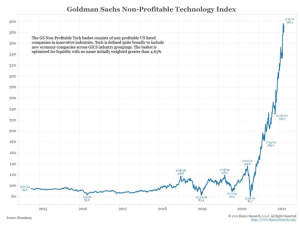

The Goldman Sachs Non-Profitable Technology Index illustrates this point very clearly. The stocks in this index consist of non-profitable U.S. listed companies in innovative industries.

As the chart shows, the index meandered about for years. There were periods of both good and poor performance but nothing out of the ordinary.

Until the lows in 2020.

The index fell sharply from 134.6 on February 20, 2020 to 81.7 on March 18th as investors ran for the exits during the COVID scare. That level represented a multi-year low.

This chart says it all.

It’s a been like a horror movie for short sellers in recent months. The index has rocketed higher from 81.7 to 393.1 with no meaningful pullbacks.

As we have discussed before in Chart of the Week, companies with the worst fundamentals are often up the most in recent times. We know how it usually ends for these stocks. With a lot of blood and guts.

It’s never too easy for long in the markets. That’s why what’s uncomfortable is often the action we should be taking.

Now is the time to get serious about hedges.

While the move off the low for technology stocks losing money has been breathtaking, we have never seen a market sustain a parabolic move.

The Active Alts SentimenTrader Long / Short Strategy returned 25.87% last year with an average cash position of 19.4%.

Past performance is not indicative of future results. Active Alts is affiliated with Lamensdorf Market Timing Report. While LMTR uses charts from SentimenTrader, they do not have a financial arrangement with SentimenTrader.