Americans are Broke (Again)

By John Del Vecchio and Brad Lamensdorf

Soon after COVID hit, Americans were flush with cash. Americans saved at a record pace with nothing else to do but sit at home.

Some decided to speculate from their couch on equities, options, and cryptocurrencies. But plenty of folks stuffed the stimulus money under the mattress.

For a little while…

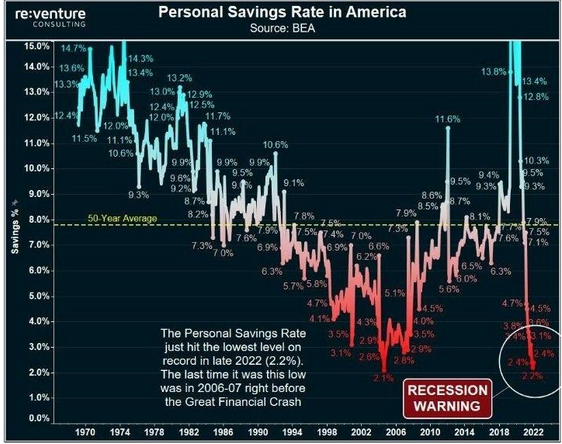

The chart below shows that the personal saving rate has fallen to just 2.2% from over 14% in two years. This is well below the 50-year average of nearly 8% and the lowest since 2006-07, before a major financial crash.

With inflation reaching multi-decade highs, Americans are tapping into savings to stay afloat.

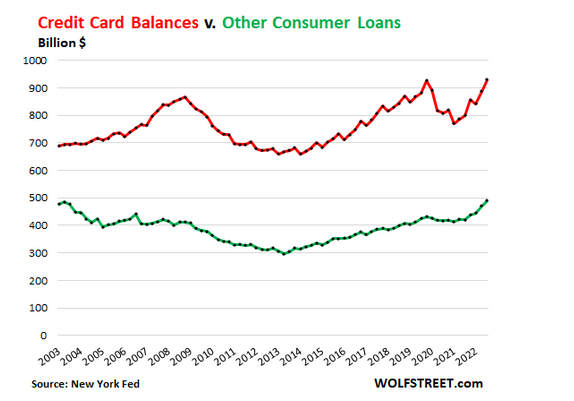

Many others are engaging in America’s favorite pastime, buying stuff they don’t need with money they don’t have and paying 25% interest on their credit card balance.

Either way, the plummeting savings rate is a significant recession warning.

In addition to nosediving savings, folks are spending on their credit cards. Credit card balances have surged back to pre-pandemic highs. Consumer loans are hitting 20-year highs as well.

This double whammy of practically no savings and high-interest credit card balances and loans tends only to end one way…badly…

To learn more about how these indicators can help manage risk in your portfolio, book a call with Brad. You may book a call here.

DISCLOSURE: LAMENSDORF MARKET TIMING REPORT

Lamensdorf Market Timing Report is a publication intended to give analytical research to the investment community. Lamensdorf Market Timing Report is not rendering investment advice based on investment portfolios and is not registered as an investment advisor in any jurisdiction. Information included in this report is derived from many sources believed to be reliable but no representation is made that it is accurate or complete, or that errors, if discovered, will be corrected. The authors of this report have not audited the financial statements of the companies discussed and do not represent that they are serving as independent public accountants with respect to them. They have not audited the statements and therefore do not express an opinion on them. The authors have also not conducted a thorough review of the financial statements as defined by standards established by the AICPA.

This report is not intended, and shall not constitute, and nothing herein should be construed as, an offer to sell or a solicitation of an offer to buy any securities referred to in this report, or a “buy” or “sell” recommendation. Rather, this research is intended to identify issues portfolio managers should be aware of for them to assess their own opinion of positive or negative potential. The LMTR newsletter is NOT affiliated with any ETF’s. Active Alts is affiliated with Lamensdorf Market Timing Report. While LMTR uses charts from SentimenTrader, they do not have a financial arrangement with SentimenTrader Past performance is not indicative of future results.