Stock Market Capitalization vs GDP Shows More Pain Ahead

By John Del Vecchio and Brad Lamensdorf

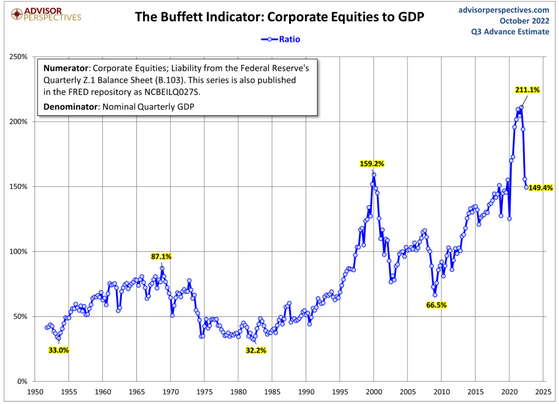

While 2022 has been a brutal year for the markets, Warren Buffet’s favorite indicator is still only back to levels seen in 2000.

Now, we have had a massive rally off of deeply oversold levels. While we warned that shorts could get punched in the nose from an oversold rally, it’s unlikely that it would represent the start of a new bull market.

Now that the market is exceptionally overbought, we continue to believe this is the case. Few stocks are making new highs. Breadth has been poor on some of the strong rally days.

Meanwhile, indicators such as The Buffet Indicator illustrate that we likely have a way to go before reaching a major bottom.

Continued caution is warranted over the long term.

To learn more about how these indicators can help manage risk in your portfolio, book a call with Brad. You may book a call here.

DISCLOSURE: LAMENSDORF MARKET TIMING REPORT

Lamensdorf Market Timing Report is a publication intended to give analytical research to the investment community. Lamensdorf Market Timing Report is not rendering investment advice based on investment portfolios and is not registered as an investment advisor in any jurisdiction. Information included in this report is derived from many sources believed to be reliable but no representation is made that it is accurate or complete, or that errors, if discovered, will be corrected. The authors of this report have not audited the financial statements of the companies discussed and do not represent that they are serving as independent public accountants with respect to them. They have not audited the statements and therefore do not express an opinion on them. The authors have also not conducted a thorough review of the financial statements as defined by standards established by the AICPA.

This report is not intended, and shall not constitute, and nothing herein should be construed as, an offer to sell or a solicitation of an offer to buy any securities referred to in this report, or a “buy” or “sell” recommendation. Rather, this research is intended to identify issues portfolio managers should be aware of for them to assess their own opinion of positive or negative potential. The LMTR newsletter is NOT affiliated with any ETF’s. Active Alts is affiliated with Lamensdorf Market Timing Report. While LMTR uses charts from SentimenTrader, they do not have a financial arrangement with SentimenTrader Past performance is not indicative of future results.