Is the Bear Market Over?

By John Del Vecchio and Brad Lamensdorf

The market has had a powerful rally.

Low-quality stocks have bounced strongly.

This is typical of a bear market rally. Bear market rallies are typically very powerful.

Is the bear market over?

While it could be, certain conditions exist that typically do not indicate the start of a new bull market.

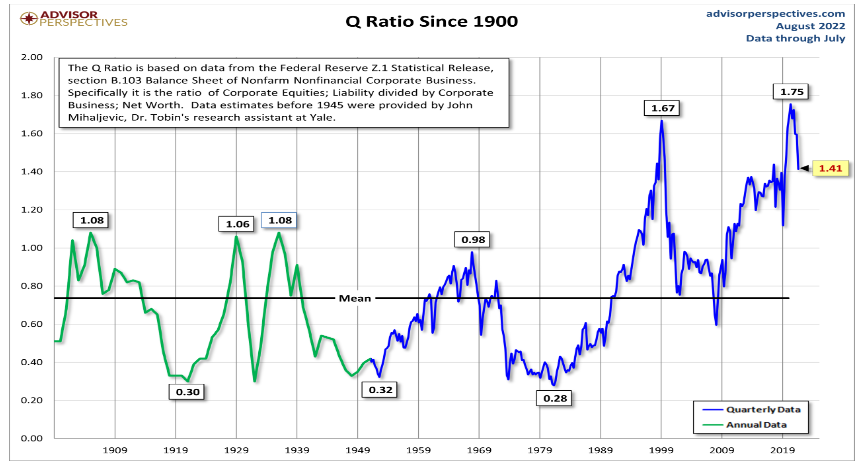

Consider Tobin’s-Q. The Q-Ratio measures the market value of companies divided by their assets’ replacement cost.

The indicator has been around for decades.

Coming into the most recent bear market, the Q-Ratio was at 1.75x. An all-time high.

It now sits at 1.41x, still an historically high level.

If history is any guide, we would not expect a new bull market to start from current levels.

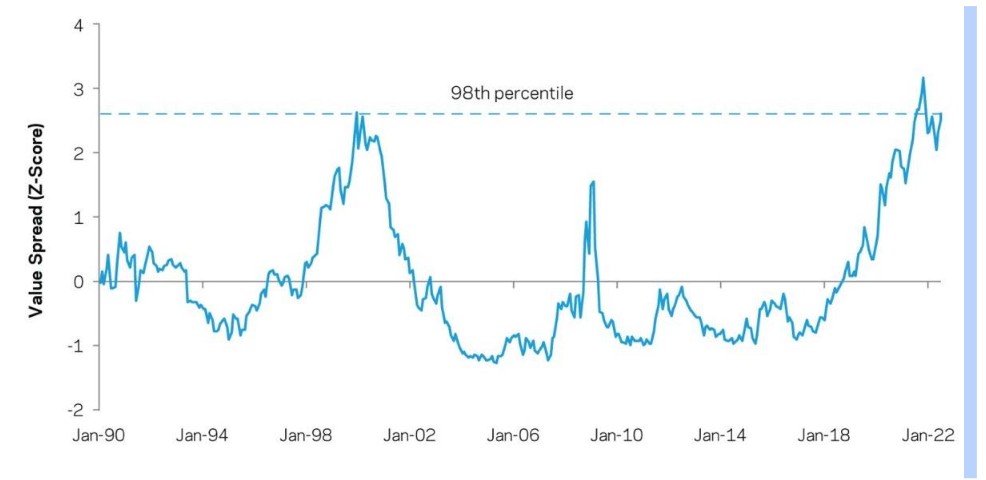

Meanwhile, valuation spreads remain at nosebleed levels.

The following chart, courtesy of Chris Cooper, illustrates that the valuation spreads are still at 30-year highs.

Spreads are constructed using five value measures: book-to-price, earnings-to-price, forecast earnings-to-price, sales-to-enterprise value, and cash flow-to-enterprise value. Spreads are measured based on ratios and are adjusted to be dollar-neutral, but not necessarily beta-neutral through time.

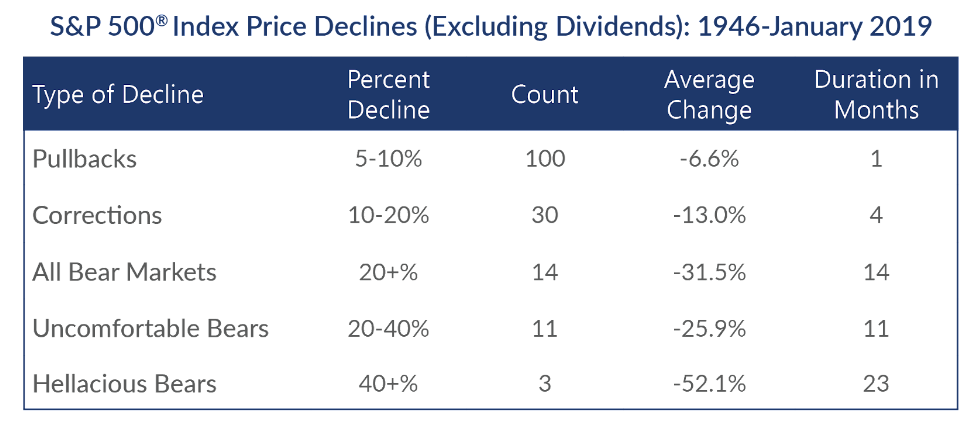

Meanwhile, if the bear market is over, it would represent an historically short period of market pain.

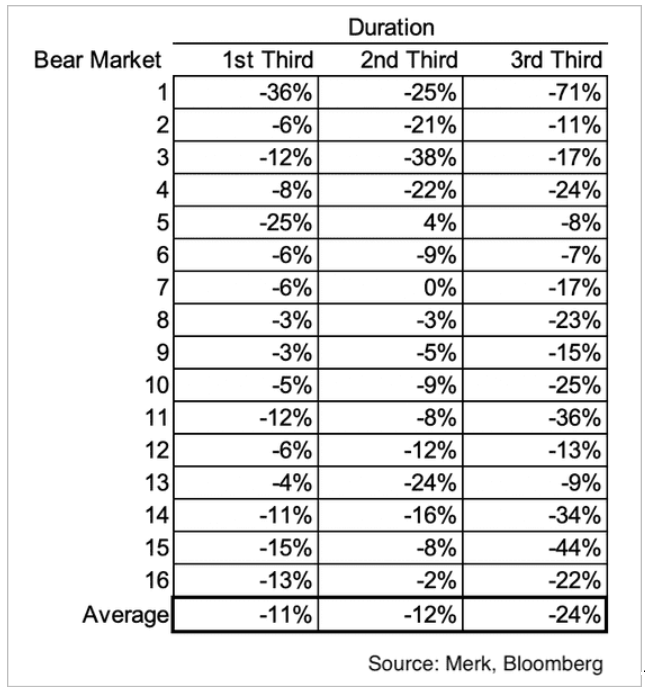

Given the historically high valuations and unfavorable liquidity situation, the odds favor being through the first third of a bear market.

More pain to come.

It’s time to consider additional hedges.

To learn more about how these indicators can help manage risk in your portfolio, book a call with Brad. You may book a call here.

DISCLOSURE: LAMENSDORF MARKET TIMING REPORT

Lamensdorf Market Timing Report is a publication intended to give analytical research to the investment community. Lamensdorf Market Timing Report is not rendering investment advice based on investment portfolios and is not registered as an investment advisor in any jurisdiction. Information included in this report is derived from many sources believed to be reliable but no representation is made that it is accurate or complete, or that errors, if discovered, will be corrected. The authors of this report have not audited the financial statements of the companies discussed and do not represent that they are serving as independent public accountants with respect to them. They have not audited the statements and therefore do not express an opinion on them. The authors have also not conducted a thorough review of the financial statements as defined by standards established by the AICPA.

This report is not intended, and shall not constitute, and nothing herein should be construed as, an offer to sell or a solicitation of an offer to buy any securities referred to in this report, or a “buy” or “sell” recommendation. Rather, this research is intended to identify issues portfolio managers should be aware of for them to assess their own opinion of positive or negative potential. The LMTR newsletter is NOT affiliated with any ETF’s. Active Alts is affiliated with Lamensdorf Market Timing Report. While LMTR uses charts from SentimenTrader, they do not have a financial arrangement with SentimenTrader Past performance is not indicative of future results.