You’re Being Robbed of Trillions with Low Interest Rates, and Don’t Even Know It…

By John Del Vecchio

“This article originally appeared in The Rich Investor”

Central bankers are the biggest crooks on the face of the earth. John Gotti and Pablo Escobar are practically saints in comparison. Here’s the thing… Central bankers are keeping interest rates low. In many cases, they’re negative. This trend is expected to last for a generation.

A Lasting Scenario

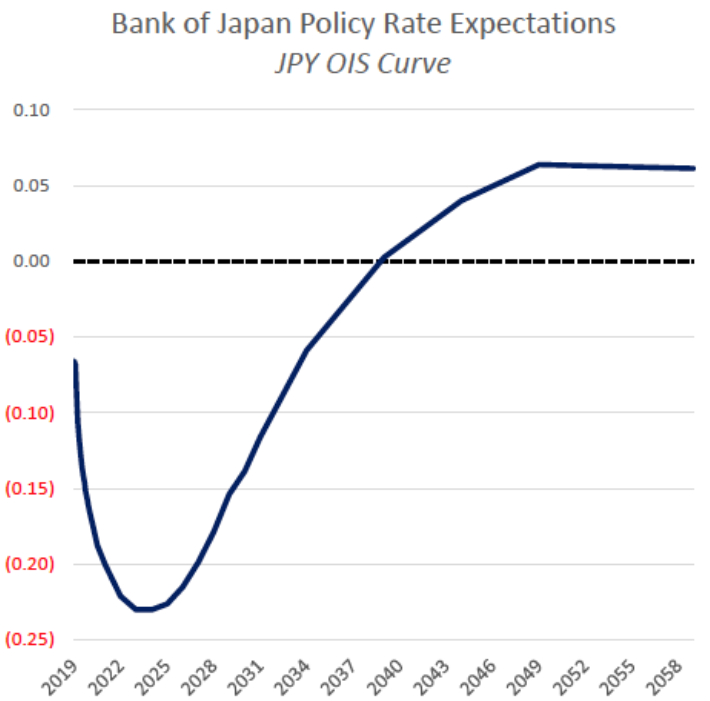

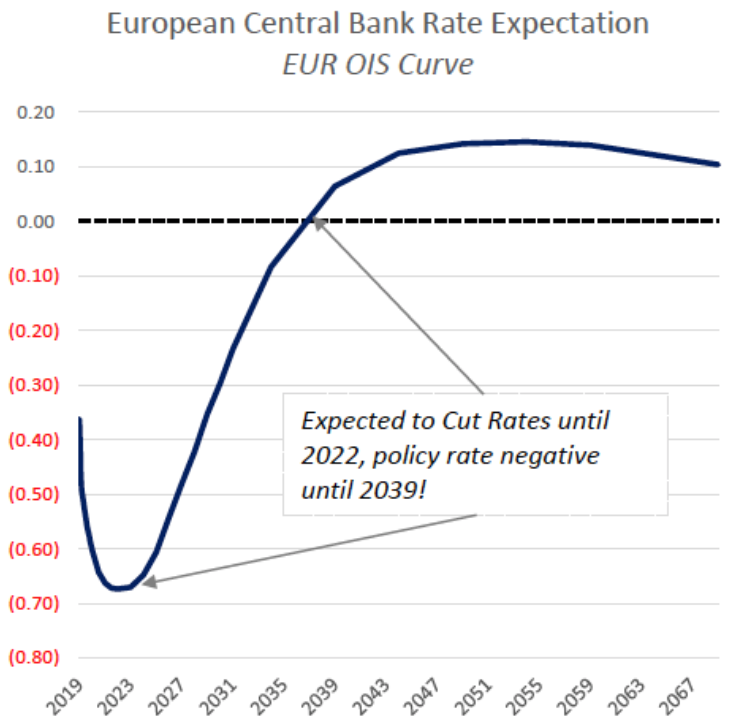

Take a look at these charts:

Interest rates are expected to be negative in Europe and Japan for 20 more years.

Yup, you read that right. Twenty. More. Years. Those rates may not even bottom out until 2022 or 2023. Add in the time they’ve been artificially low and you’re talking the lifetime of an entire generation. It’s unprecedented in history. Even worse, Europe and Japan have lousy demographics. It’s a total disaster. So, I’m skeptical that rates will even trend back up. We may even find ourselves bogged down by this scenario forever. What makes these central bankers’ thieves? Well, they’re robbing trillions of dollars in wealth from the good folks like you who work hard and save. Trillions of dollars robbed, year after year. This has been going on for nearly a decade. The thing is, no one will ever go to jail for this grand heist. The bankers put on their fancy conferences, dine on Dover sole, sip champagne, and make Wall Street’s rich richer while you get caught holding the bag.

So, What Can You Do About It?

As an investor, you’ll have to chase some yield.

Though not all dividend yielding stocks are the same. Some yields are high for a reason — the underlying stock is junk.

That’s why in Hidden Profits I’m looking for stocks with fat yields and are good values with solid cash flows. This month, I’ve recommended one such stock. The company has survived numerous cyclical downturns. Its business is set up to weather economic storms. The yield is fat. Cash flow is strong. And the valuation makes it a good buy. There’s 50% or more upside in the stock at today’s prices. There’s a second recommendation in Hidden Profits, too. It’s a simple special situation play. You don’t need a calculator to figure out the value. It’s another 50% or more upside sitting out there, hidden in plain sight.

The company is well-managed and a dominant player in its three core markets. The guy at the helm is a business legend. He has huge incentives to unlock this obvious value. That makes it a great bet, here and now. That’s a change I’ve made in Hidden Profits. I’ll have two recommendations for you each month to provide more choice and, most important, more value. If you choose to do nothing, your savings will be eaten away. Your pocket picked. No jail time served for the multitrillion-dollar theft of central bankers. That’s the world we live in today.

Adapt or go broke. The choice is yours.

John Del Vecchio

John Del Vecchio is the author of the bestselling book, Rule of 72: Compound Your Money and Uncover Hidden Stock Profits and What’s Behind The Numbers: A Guide To Exposing Financial Chicanery And Avoiding Huge Losses In Your Portfolio.

As the in-house stock market guru and forensic accountant for Dent Research, John stood on the shoulders of the great David Tice, James O’Shaughnessy and Dr. Howard Schilit, and built a framework of algorithms and a multi-factor grading system that has made him one of the more successful short-sellers around.

John is also the executive editor of our Hidden Profits newsletter and our trading service Small Cap All-Stars.

He graduated Summa Cum Laude from Bryant College with a B.S. in Finance and was awarded Beta Gamma Sigma honors. He earned the right to use the Chartered Financial Analyst designation in September 2001.

[email protected]