Watch this Trend for Changing Stock Market Fortunes

By John Del Vecchio

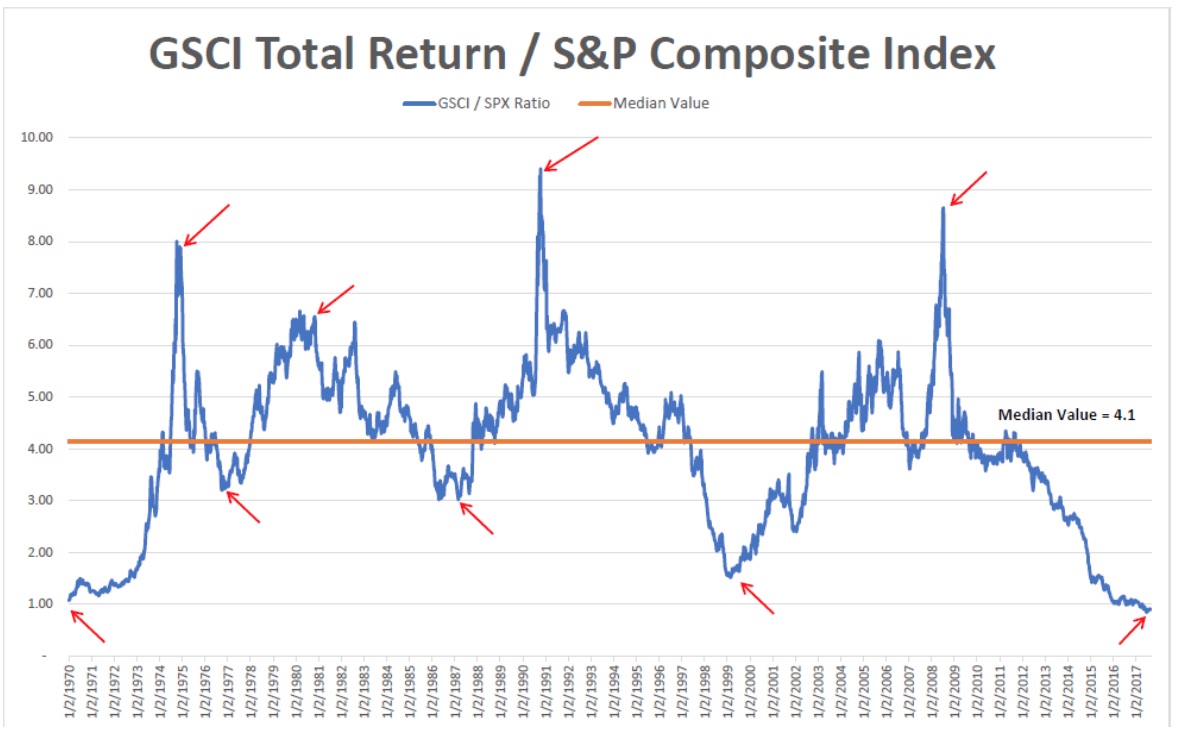

I like to look for extremes in the markets. Extremes often pinpoint areas where returns can be higher and risk lower than in other time periods. Take the relationship between commodities and stocks. The chart below shows that commodities haven not been cheaper than stocks in a generation.

Could the relationship between commodities and stocks have changed forever? Possibly. We often hear “this time it is different” to justify what’s going on in the world. But, one thing that never changes is human nature.

People push markets to extremes. Then they revert.

You see this in the real world. Have you ever noticed in a basketball game that a team gets really hot in the first half of the game? Blazing hot. The players are nailing three pointers and outside jumpers and guys coming off the bench score more in the first half than they typically do in a game.

Then in the second half the team falls apart. They can’t buy a layup. Meanwhile, the opponent plays a bit better and catches up. The hot team has reverted to their mean.

It happens all the time.

When markets revert, there can be big returns with much less risk.

So, what to do with commodities and stocks? Well, the stock market has had one of the longest bull runs in history. We are way overdue for a meaningful pullback. Commodities are cheap relative to stocks. But, that doesn’t automatically make them a screaming buy. They have been below the median level for six years and headed lower! Additionally, we could have a deflationary bust that wipes out wealth beyond comparison.

What it means to me is to raise cash, not allocate fresh capital to stocks and be on the lookout for changes in trends in the stock market. These generational lows won’t hold. So, it will pay to watch this trend going forward to look for the beginnings of the reversion to the mean. It could make you a lot of money. But, more importantly, shield you from big losses in stocks.