Morgan Stanley Issues Rare “Sell” Signal, Are You Prepared?

By Brad Lamensdorf, CEO Active Alts

Morgan Stanley recently issued a rare sell signal on the U.S. market. Are you prepared?

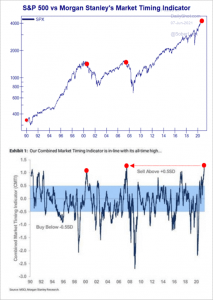

As the chart below shows, Morgan Stanley’s composite market timing indicator has reached new highs, which is bearish for the markets. Previous major signals include 1990, 2000, and 2007, which all preceded dramatic declines in equity indexes.

While the historical track record of the signal is impressive, current conditions in the market suggest that the next decline could be fierce.

Consider that U.S. households are fully invested in equities, and margin debt is exploding. Both are contrary indicators.

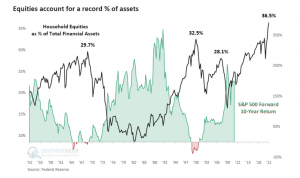

As the following chart illustrates, household equities as a percent of total financial assets have hit a new high of 36.5%.

This tops the previous highs of 29.7% in the late 1960s and 32.5% near the turn of this century that preceded negative 10-year annualized returns in the market.

Quite simply, households are loaded to the gills in equities. Their holdings are more than double that of 2009, which represented a generational buying opportunity in stocks. That cycle may be coming to an end.

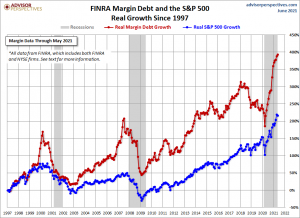

Should the cycle be coming to an end, leverage will only add fuel to the fire. The amount of margin debt has exploded and in real dollars is outside the norm of historical ranges.

Real growth in margin debt is literally off the charts. The following charts, courtesy of Advisor Perspectives, show that real growth in margin debt has dramatically outpaced the rally in U.S. stocks over the past 12 years.

The trend has accelerated since the COVID lows were hit last year.

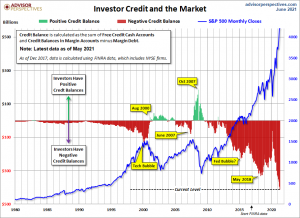

Lastly, negative credit balances far exceed previously known bubbles.

The unwind is likely to happen swiftly and with tremendous damage. Morgan Stanley is making a rare bearish call on the market.

Are you prepared?

To learn more about how these indicators can help manage risk in your portfolio, book a call with Brad.

DISCLOSURE: LAMENSDORF MARKET TIMING REPORT

Lamensdorf Market Timing Report is a publication intended to give analytical research to the investment community. Lamensdorf Market Timing Report is not rendering investment advice based on investment portfolios and is not registered as an investment advisor in any jurisdiction. Information included in this report is derived from many sources believed to be reliable but no representation is made that it is accurate or complete, or that errors, if discovered, will be corrected. The authors of this report have not audited the financial statements of the companies discussed and do not represent that they are serving as independent public accountants with respect to them. They have not audited the statements and therefore do not express an opinion on them. The authors have also not conducted a thorough review of the financial statements as defined by standards established by the AICPA.

This report is not intended, and shall not constitute, and nothing herein should be construed as, an offer to sell or a solicitation of an offer to buy any securities referred to in this report, or a “buy” or “sell” recommendation. Rather, this research is intended to identify issues portfolio managers should be aware of for them to assess their own opinion of positive or negative potential. The LMTR newsletter is NOT affiliated with any ETF’s. Active Alts is affiliated with Lamensdorf Market Timing Report. While LMTR uses charts from SentimenTrader, they do not have a financial arrangement with SentimenTrader Past performance is not indicative of future results.