You’ll Be Wishing the Short Sellers Were Still Here

As previously published in The Rich Investor: By John Del Vecchio

You’ll be wishing the short Sellers were still here. On Monday global stocks suffered one of the worst drops in the last 10 years. The one-day loss ranks as the fifth-biggest for the decade.

Of course, the market has bounced back from previous scares. Federal Reserve tapering, BREXIT, and the volatility disaster didn’t keep stocks down for long.

But the recent virus scare comes at a fragile time for U.S. markets.

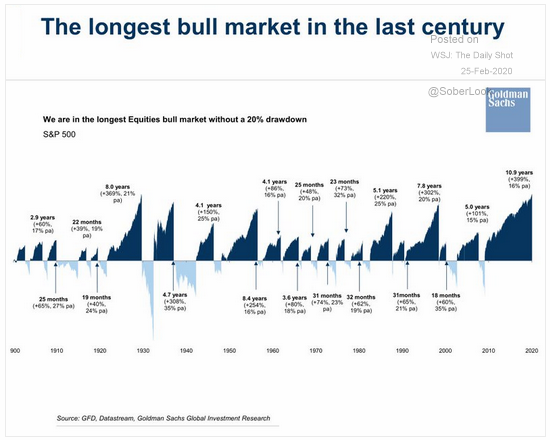

We are in the longest bull market of the last century. I’m willing to best that makes it the longest in your lifetime.

That’s quite the move over the past 10.9 years. Almost straight up. Barely a squiggle on the path to new highs.

Under the surface though are concerns. Big concerns.

For one, fundamentals are starting to worsen. As I’ve mentioned in numerous previous articles, gains in technology stocks, for example, have been driven entirely by valuation expansion. That’s not sustainable.

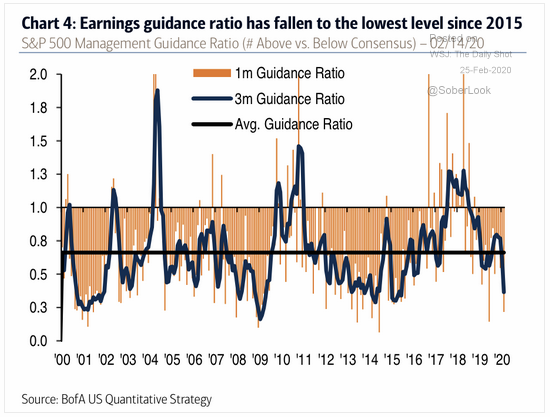

Corporate guidance is starting to turn down.

The chart shows quite a plunge from 2017 to today. We are at the lowest levels since 2015. Could it go lower? You betcha!

The impact on the economy for Coronavirus can’t be waived aside. China’s growth may fall from 6% to 4.5% on the virus alone. That’s a huge percentage move.

In addition, when SARs was raging, China was growing almost twice as fast. Since then growth has slowed and debt levels have ballooned.

I see the impact in my own life. I’ve been fortunate to travel all over the world. But I’ve never been to Italy. Over the past 15 years something seems to have popped up each year. Mostly I have traveled somewhere else instead.

Just a few weeks ago I was making plans. Now they are on hold.

Coronavirus just exploded in Italy in the past few days. I’ll wait and see what happens, but I’m not going there to spend money on airfare and sightseeing and most likely neither is anyone else.

These type of travel disruptions represent just one of many strains on the global economy that will continue to ripple as the virus spreads to more countries.

Companies will be cautious. This comes at a time when revenue growth is slowing and profit margins have peaked. Tax cuts have come and gone. Stock buybacks are slowing. Buybacks have been a major driver of stock returns.

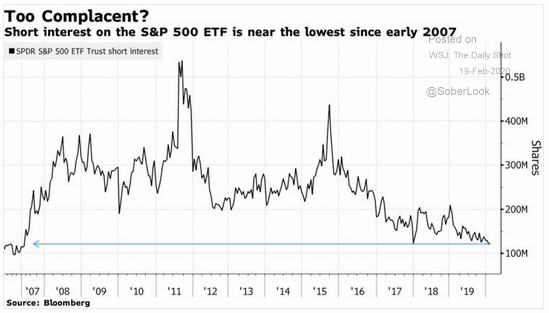

While stocks have hit new highs, short sellers have been blown out. It might be fun for people to cheer the demise of short sellers. After all, they’re un-American, right?

I started shorting stocks in 2000. Back then, you could fill several pages of dedicated short sellers. Today you could fit in on a postage stamp. There’s barely anyone left.

Short interest on the S&P 500 ETF has nosedived. It’s now at the same levels we saw just before the ass kicking that resulted in the Great Recession.

The difference is there’s very few shorts left. Shorts are buyers of stock in a panic. They’re covering stock and booking gains. Shorts provide a floor for stock prices.

What happens when no one is left?

Ugly. Very ugly.

I don’t know if Coronavirus is the catalyst for a big decline in the markets over time. The market has ignored other concerns that have popped up over the last decade. I do know that another bear market will come. When it does, the combination of complacency, weak fundamentals, and few short sellers left in the game will lead to a bigger than normal butt whooping.

Get prepared for a wild ride!