Massive Leverage Suggests Painful Downside (When it Comes)

By John Del Vecchio and Brad Lamensdorf

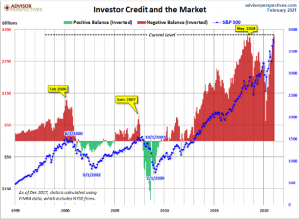

Many investors have short-term memories. In late 2018 as speculators came off margin

there was a very painful decline. Speculators got a lump of coal in their stocking for

Christmas that year. This set up a very tradable bounce in early 2019.

Fast forward to 2020, and take a look at just how fast the balances decline once COVID

hit. While COVID by itself was a scary event for the markets and the world at large, the

massive amount of negative balances likely contributed to the pace and severity of the

decline. It was a record for the shortest time from a bull market to a bear market.

That record may be broken next time as negative balances have exploded yet once

again.

By itself, the level of margin is not an indicator that market is about to crater. In

fact, short-term we are bullish as the market, particularly in technology stocks

became too oversold.

However…

When the tide turns, this will just make the downside just that much worse. It will likely

happen swiftly as peculators come off margin all at once

There are pockets of speculation everywhere. Look at the watch market. Steel Rolex

watches are through the roof, in just 2021 alone. That’s just one example among many.

Of course, people can borrow against their portfolio to purchase all sorts of baubles.

Items that have no liquidity in a swift move to the downside. Shockingly, the banks don’t

much care what you buy when you borrow against your portfolio.

This too will lead to more pain once the market experiences a downdraft.

In our view, this presents opportunities going forward for individual stock selection and

for tactical risk management.

To learn more about how these indicators can help manage risk in your portfolio, book a call with Brad.

DISCLOSURE: LAMENSDORF MARKET TIMING REPORT

Lamensdorf Market Timing Report is a publication intended to give analytical research to the investment community. Lamensdorf Market Timing Report is not rendering investment advice based on investment portfolios and is not registered as an investment advisor in any jurisdiction. Information included in this report is derived from many sources believed to be reliable but no representation is made that it is accurate or complete, or that errors, if discovered, will be corrected. The authors of this report have not audited the financial statements of the companies discussed and do not represent that they are serving as independent public accountants with respect to them. They have not audited the statements and therefore do not express an opinion on them. The authors have also not conducted a thorough review of the financial statements as defined by standards established by the AICPA.

This report is not intended, and shall not constitute, and nothing herein should be construed as, an offer to sell or a solicitation of an offer to buy any securities referred to in this report, or a “buy” or “sell” recommendation. Rather, this research is intended to identify issues portfolio managers should be aware of for them to assess their own opinion of positive or negative potential. The LMTR newsletter is NOT affiliated with any ETF’s. Active Alts is affiliated with Lamensdorf Market Timing Report. While LMTR uses charts from SentimenTrader, they do not have a financial arrangement with SentimenTrader Past performance is not indicative of future results.