Market Sentiment Remains Frothy into New Year

By John Del Vecchio and Brad Lamensdorf

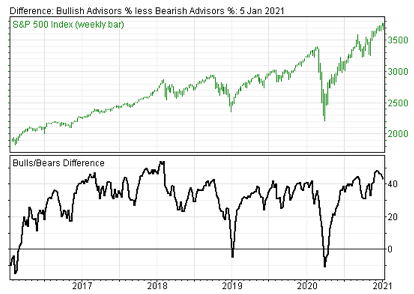

The froth in market sentiment has backed off a bit but still in the danger zone. Stock market bulls still top 60%, and while bears have inched up a bit, the spread between the two exceeds nearly 43%.

As the chart below from Investors Intelligence shows, the bull/bear spread is still in the upper end of the range over recent history. Proceed with caution. We are still in the danger zone.

As we noted in the most recent Chart of the Week, there’s a fascinating piece from GMO published December 8, 2020 that talks about the bloodbath in value investing.

If you’re not familiar with GMO they manage over $60 billion. And the “G” in GMO refers to Jeremy Grantham who conducted groundbreaking work on quality metrics in the 1970’s.

To recap the gory details, here’s a synopsis from their report:

“After more than a decade of disappointing performance, Value stocks just experienced their worst 12-month performance in history. This has left these stocks trading at some of the cheapest levels relative to the market we have ever seen. This cheapness is robust to a variety of challenges that skeptics may raise, and this is true broadly across all major equity regions. An analysis of the sources of returns for Value since 2007 shows that more than 100% of Value’s underperformance is due to falling relative valuations, confirming that under the surface the Value premium actually still exists. If Value were to continue trading at current spreads to the market and experienced the same relative fundamental performance as it has over the past 14 years, it would beat the market. The flip side of the extraordinary cheapness of Value is the expensiveness of Growth: we believe Growth stocks have entered a bubble similar to the one in 2000. While we are not sure what the catalyst will be for the deflation of the Growth bubble and the recovery for Value, there are a number of plausible candidates for one, not least the eventual recovery of the global economy over the next 12-18 months as the pandemic recedes. We believe the outlook for Value is exceedingly bright from here, particularly in a long/short framework, which can profit from Value’s outperformance in both rising and falling markets.”

Even if we are entering another bubble in growth stocks, plenty of opportunity exists in the market. Closing the massive spread between value and the market will create huge opportunities for alpha in the coming years.

What’s more is that not all value stocks are the same. Some stocks are cheap for a reason. In our own work, we saw value, combined with quality and momentum, perform well in 2020. And, we agree that long / short is poised to perform well going forward.

Active Alts operates two strategies to navigate through all market conditions.

The long-only, Active Alts Focused Momentum Strategy was up 79.60% in 2020. What’s more, 2020’s performance was achieved with an average exposure of 74.87%.

In December, the strategy turned in a performance of 22.16%, with an average exposure of 55.09%.

Quality, momentum, value, and risk/reward. Those are the factors, when combined into one cohesive approach, are the engine that powers the Active Alts Focused Momentum Strategy.

The Active Alts Long / Short finished 2020 up 25.91%

That same GMO report, published December 8, 2020, is decidedly bullish on the long /short space in the future. The historical spread between value and the market is likely to revert to the mean.

This bodes well for tactical stock pickers.

Want to know more about the Active Alts Focused Momentum Strategy and the Active Alts SentmenTrader Long / Short Strategy?

Please schedule a phone call with Brad today.