Increasing Investor Optimism Puts Stock Market in Danger Zone

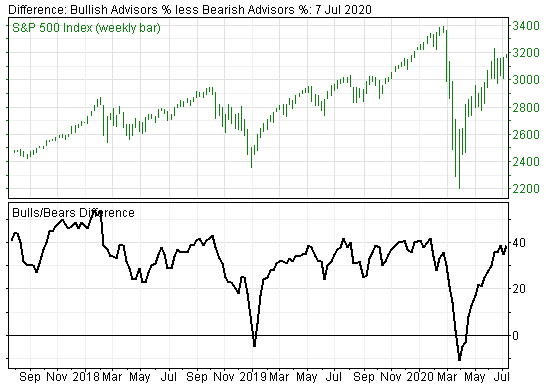

Increasing Investor Optimism Puts Stock Market in Danger Zone. We use investor stock market sentiment as historically important contrarian indicators to determine where the stock market is headed. The indicators have proved to be particularly accurate as they move closer to extreme bullish and bearish levels. This week’s Investor Intelligence survey of more than 100 editors of stock market newsletters shows bullish sentiment among the editors moving into those higher dangerous elevations, close to what occurred before the downturn earlier this year.

Bullish sentiment increased to 57.7% after a small dip to 54.5% the week before. Investor Intelligence notes that bulls above 55% mean investors should start taking defensive measures for protection against a possible downturn. Those measures include tight stops at a minimum, and possibly selling shares with big gains. In other words: Don’t be greedy! That’s inevitably a loser’s game. We should also note that bullish sentiment signals even more danger the higher it gets over 60%. And that also signals the need to prepare for a market decline. Although there’s no certainty about when the decline will occur.

Meanwhile, the market surge trimmed bearish sentiment to 18.3% from 19.8% a week ago. Bearish sentiment below 20% is not favorable for longs. The bull-bear difference expanded to +39.4% from 34.7%. That’s the widest spread since January, and another reason for being careful (See chart below).