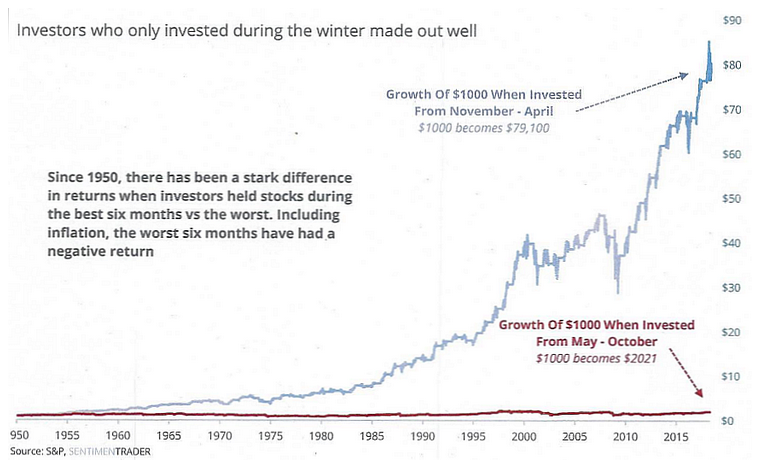

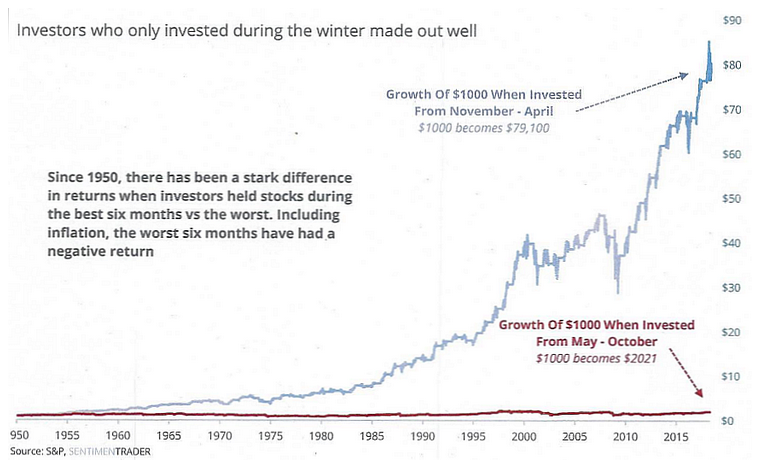

Chart of the Week 05-07-2018

Should You Sell in May and Go Away?

By John Del Vecchio

Should You Sell in May and Go Away?

By John Del Vecchio

Used Car Prices are Crashing, Meaning Big Trouble Ahead for Car Companies and other Auto Lenders. As the chart below shows, economic dislocation caused by the corona virus has triggered the biggest decline in car prices since the 2008 great recession, And some analyst say the declines this time could be far worse as a…

By John Del Vecchio and Brad Lamensdorf Wow! That was fast. The September 29 Chart of the Week highlighted a very oversold market. The TIR Indicator had plummeted. Stocks were deeply oversold. It bottomed a few days before we published the chart, courtesy of Investor Intelligence. While the indicator is volatile and measures the short-term,…

There’s Trouble Simmering Below Surface of Record Nasdaq Index Highs. The Nasdaq index record highs are being propelled by a decreasing number of stocks that compose the index. That means things are not nearly as healthy for Nasdaq stocks in general as the record highs would suggest, says Jason Goepfert of SentimenTrader. Put another way,…

By John Del Vecchio and Brad Lamensdorf Bitcoin news sucks all the oxygen out of the room. However, it’s not the only market rallying that may indicate inflation is afoot. Take a look at copper. Or oil. Or corn. Or soybeans. These commodities are flying and that is inflationary. It is no coincidence that the TLT’s are…

Jason Goepfest of Sentimentrader came out with this outstanding study last week and I wanted to share it with you. While the market continues higher the participation has become narrow and traditionally a charctoristic of a top in the stock market.

Is It Finally Time for Value Stocks? In the summer of 1979, a BusinessWeek cover story pronounced “The Death of Equities.” Three years later in 1982 the stock market hit bottom and then rocketed higher. Since then the total return on the S&P 500 index with dividends reinvested has been more than 7,000%. This legendary…

You’re about to leave this website. Click Here to open the link and visit the external site.

Active Alts Contrarian ETF (SQZZ)

Investment Objective: The investment objective of the Active Alts Contrarian ETF is to seek current income and capital appreciation.

Active Alts Contrarian ETF (SQZZ) Risks:

http://activealts.com/risks/

It is possible to lose money by investing in the Fund. The Fund may invest in other investment companies, and will fluctuate in response to the performance of the acquired funds; therefore, there may be certain additional risk expenses and tax results that would not arise if you invested directly in the securities of the acquired funds.

The Fund may invest in unaffiliated and affiliated money market funds; therefore, the Advisor is subject to conflicts of interest in allocating the Fund’s assets among the underlying funds, as it will receive more revenue from affiliated funds than from unaffiliated funds.

Although the Shares of the Fund are approved for listing on the NASDAQ stock market, there can be no assurance an active trading market will develop and be maintained for the Fund’s shares.

The Fund invests in foreign companies, which may be subject to greater risks than investing in domestic companies. Investing in the securities of small and medium capitalization companies generally involves greater risk than investing in larger, more established companies.

The Fund’s investment strategy seeks to invest in stocks in which a significant amount of market participants have taken short positions, when the market participants believe the value of these stocks will decline in the future. If these market participants are correct, the value of stocks in which the Fund invests will decrease, and the Fund will lose money on its investments.

Due to the practice of lending securities, the Fund may lose the opportunity to sell some of its securities at a desirable price.

The Fund’s portfolio is actively managed, and will likely have a higher portfolio turnover rate than non-actively managed portfolios; and it will likely experience short-term capital gains, taxed at shareholders’ ordinary income tax rates.

Shares of Exchange Traded Funds (ETFs) are not individually redeemable and owners of the shares may acquire those shares from the ETF and tender those shares for redemption to the ETF in Creation Units only, see the ETF prospectus for additional information regarding Creation Units. Investors may purchase or sell ETF shares throughout the day through any brokerage account, which will result in typical brokerage commissions.

SQZZ Prospectus: http://activealts.com/downloads/2016.09.21_Active_Alts_Contrarian_ETF_PRO.pdf

SQZZ’s distributor is Foreside Fund Services, LLC

You’re about to leave this website. Click Here to visit the Active Alts website.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to open the link and visit the external site.

You’re about to leave this website. Click Here to visit the (HDGE) Ranger Equity Bear ETF website.

Going premium will redirect you to paypal for payment