Pain

By John Del Vecchio and Brad Lamensdorf

Just one word uttered by Federal Reserve Chairman Jerome Powell has sent the markets reeling.

Powell suggested in a short speech that “reducing inflation is likely to require a period of sustained below trend growth.”

Then came the doozy. Powell said, “while higher interest rates, slower growth, and soft labor market conditions will bring down inflation, they will also bring some pain to households and businesses.”

This statement threw cold water on the idea that rate increases would abate. We have been wary for a few weeks that the recent move higher in stocks has the classic signs of a bear market rally.

Furthermore, the liquidity situation is unfavorable. Such a situation rarely coincides with the start of a new bull market.

Instead, this is a classic move where the market picks the pocket of those that jump aboard under sub-optimal conditions.

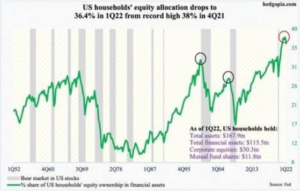

Importantly, household equity allocations have not fallen enough to be consistent with bear market lows.

Remember, markets change. Human nature does not.

Households will likely be puking up significant amounts of stock before this is all over.

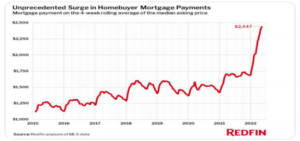

Speaking of max pain, to make matters worse, mortgage payments are going parabolic. Take a look at this chart.

Mortgage payments have more than doubled since 2015. Payments have skyrocketed at a time when folks’ 401(K)’s turned into 201(K)’s, and their most speculative holdings, such as cryptos, have been ground to dust.

Furthermore, real incomes are down since we are all getting hammered by higher energy and food costs. You know, the stuff we all use every day and whose impact is consistently undercounted in inflation reports.

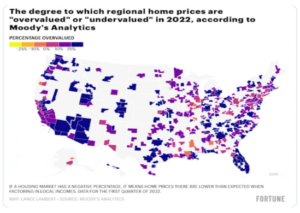

If that wasn’t bad enough, Moody’s predicts that 183 real estate markets could be in big trouble as they’re at least 25% over-priced.

According to Moody’s, several markets are exceptionally over-priced.

For example, Boise is 72% overvalued while Charlotte is 66% over-priced. Austin is 61% above its true value.

This makes sense as people have been moving to these areas in droves. Supply and demand is a fundamental law of economics.

The question is, will folks continue to migrate to these communities?

New York has plenty of overpriced markets. People cannot get out of the state fast enough. Over-priced markets in New York are going to get smoked.

And in the stupidest comment of the week, New York’s Governor suggested that 5.4 million Republicans move out of state. Very few people pay nearly all of the taxes in New York City to support the millions of others that live there. Further mass exodus threatens to turn those markets in New York into a third-world country.

Meanwhile, the state of Florida is practically entirely over-priced by 25%. Yet, people can’t get down there fast enough.

All markets are not created equal.

That said, there will be some significant pain in certain areas. That could lead to people dumping stocks and exert downward pressure on the market.

Time to hedge up.

To learn more about how these indicators can help manage risk in your portfolio, book a call with Brad. You may book a call here.

DISCLOSURE: LAMENSDORF MARKET TIMING REPORT

Lamensdorf Market Timing Report is a publication intended to give analytical research to the investment community. Lamensdorf Market Timing Report is not rendering investment advice based on investment portfolios and is not registered as an investment advisor in any jurisdiction. Information included in this report is derived from many sources believed to be reliable but no representation is made that it is accurate or complete, or that errors, if discovered, will be corrected. The authors of this report have not audited the financial statements of the companies discussed and do not represent that they are serving as independent public accountants with respect to them. They have not audited the statements and therefore do not express an opinion on them. The authors have also not conducted a thorough review of the financial statements as defined by standards established by the AICPA.

This report is not intended, and shall not constitute, and nothing herein should be construed as, an offer to sell or a solicitation of an offer to buy any securities referred to in this report, or a “buy” or “sell” recommendation. Rather, this research is intended to identify issues portfolio managers should be aware of for them to assess their own opinion of positive or negative potential. The LMTR newsletter is NOT affiliated with any ETF’s. Active Alts is affiliated with Lamensdorf Market Timing Report. While LMTR uses charts from SentimenTrader, they do not have a financial arrangement with SentimenTrader Past performance is not indicative of future results.