Max Greed

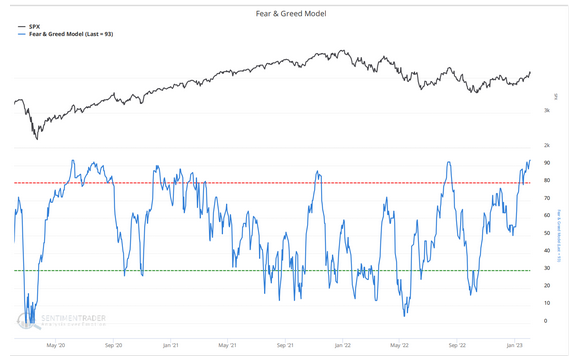

We have now reached max greed in the markets. Below is a modified version of the CNN Fear & Greed Index.

The chart shows that the index has pierced the 90% level, indicative of maximum greed.

At extremes, this index helps understand market sentiment. After a huge run in the market to start the year, complacency is setting in. While the index does not predict future returns, generally, extreme greed readings coincide with a more challenging market environment.

It is time to tighten stops and consider hedges.

This version is provided courtesy of SentimenTrader.com, and their model is more refined than the CNN model. The construction of the model is discussed below the chart.

Construction:

This is a model based on the one published by CNN on their public website (we suggest you visit their site to learn more about the model). This is our calculation of the model based on the inputs discussed on their website. It does not reflect the values published by CNN, rather it is our interpretation of the model. We use different inputs for the put/call ratio to more accurately reflect trading activity, and a different junk bond input to avoid some issues with using an ETF-based value. The model measures inputs such as price trend, volatility, options trading, and bond trading to determine prevailing investor sentiment. It should be interpreted in a similar way as other sentiment indicators and models, with rising optimism being good for stocks until it reaches extreme optimism, in which case it becomes a contrary indicator the more optimistic it gets. The inverse is also true, with declining optimism being a negative for stocks until it reaches an extreme, in which case it begins being a contrary positive indicator.

To learn more about how these indicators can help manage risk in your portfolio, book a call with Brad. You may book a call here.

DISCLOSURE: LAMENSDORF MARKET TIMING REPORT

Lamensdorf Market Timing Report is a publication intended to give analytical research to the investment community. Lamensdorf Market Timing Report is not rendering investment advice based on investment portfolios and is not registered as an investment advisor in any jurisdiction. Information included in this report is derived from many sources believed to be reliable but no representation is made that it is accurate or complete, or that errors, if discovered, will be corrected. The authors of this report have not audited the financial statements of the companies discussed and do not represent that they are serving as independent public accountants with respect to them. They have not audited the statements and therefore do not express an opinion on them. The authors have also not conducted a thorough review of the financial statements as defined by standards established by the AICPA.

This report is not intended, and shall not constitute, and nothing herein should be construed as, an offer to sell or a solicitation of an offer to buy any securities referred to in this report, or a “buy” or “sell” recommendation. Rather, this research is intended to identify issues portfolio managers should be aware of for them to assess their own opinion of positive or negative potential. The LMTR newsletter is NOT affiliated with any ETF’s. Active Alts is affiliated with Lamensdorf Market Timing Report. While LMTR uses charts from SentimenTrader, they do not have a financial arrangement with SentimenTrader Past performance is not indicative of future results.