Companies are Raising Their Earnings Outlook: Be Careful!

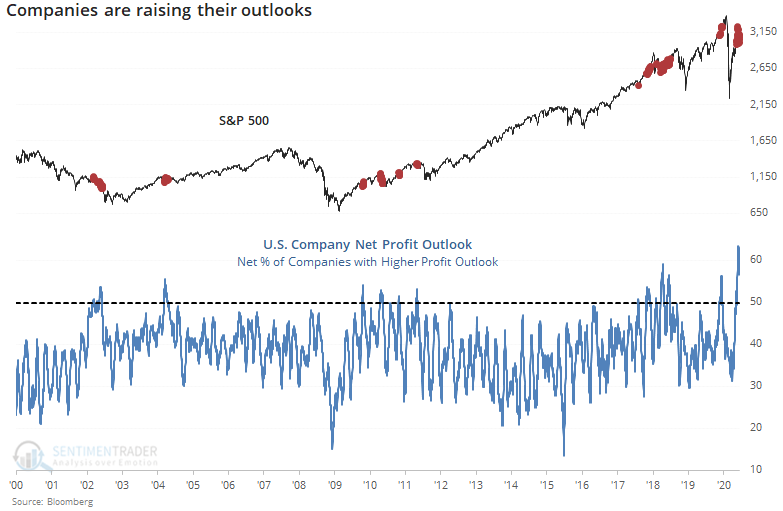

Companies are Raising Their Earnings Outlook: Be Careful! Spurred by pandemic fears many companies earlier this year pulled way back on their profit outlooks. In fact, many said they couldn’t make any predictions at all. In recent weeks, however, with an increase in business openings and employment, these companies, and the analysts who follow them, have become increasingly optimistic about future earnings. As the chart below shows, a great percentage of companies are raising their earnings. In fact, by some definitions companies haven’t raised their outlooks to this degree in 20 years.

So ,why are we telling you to be careful? The most obvious reason is that record daily Covid-19 infections now are forcing even the reddest states to close many businesses that had been reopened. So, the economic outlook may not be as rosy as the companies thought, despite June’s big employment growth. Equally important is that historically by the time companies have become this enthusiastic about future earnings, investors and the market already have anticipated the gains. That means the stocks and the indexes are already fully priced in anticipation of the higher earnings, And fully priced means that bad news, including lower-than expected earnings, is a setup for a big market drop. So be careful and don’t become victim to irrational actions spurred by the fear of missing out (FEMO). FEMO historically results in investors buying too high and selling too low.