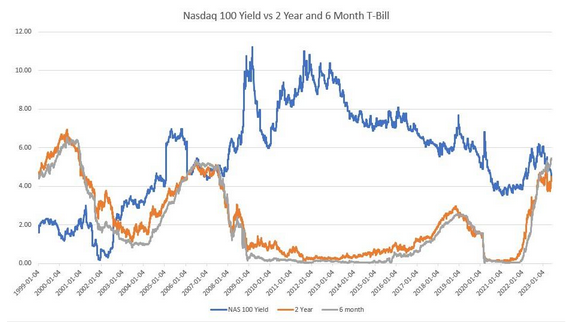

Nasdaq 100 Triggers Sell Signal

The total yield of the Nasdaq 100 (blue line) has collapsed, while 2-year (orange line) and 6-Month (grey line) government rates have surged.

As a result, the average stock in the Nasdaq 100 is looking incredibly expensive.

(Our measure of the Nasdaq 100 yield is the sum of EBIT over the past 12 months plus dividends paid out over the past 12 months and then divided by the sum of all market caps. The major difference will be that this is an equal-weight ‘total yield’ instead of a cap-weighted total yield.)

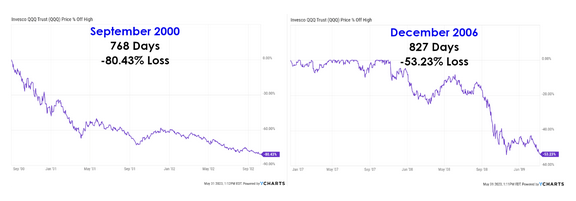

When these conditions presented themselves previously, the Nasdaq 100 experienced gut-wrenching drawdowns when valuations were in nosebleed territory.

Here are the drawdowns in percentage terms and the number of days underwater.

Ugly.

Time for hedges…

To learn more about how these indicators can help manage risk in your portfolio, book a call with Brad.

DISCLOSURE: LAMENSDORF MARKET TIMING REPORT

Lamensdorf Market Timing Report is a publication intended to give analytical research to the investment community. Lamensdorf Market Timing Report is not rendering investment advice based on investment portfolios and is not registered as an investment advisor in any jurisdiction. Information included in this report is derived from many sources believed to be reliable but no representation is made that it is accurate or complete, or that errors, if discovered, will be corrected. The authors of this report have not audited the financial statements of the companies discussed and do not represent that they are serving as independent public accountants with respect to them. They have not audited the statements and therefore do not express an opinion on them. The authors have also not conducted a thorough review of the financial statements as defined by standards established by the AICPA.

This report is not intended, and shall not constitute, and nothing herein should be construed as, an offer to sell or a solicitation of an offer to buy any securities referred to in this report, or a “buy” or “sell” recommendation. Rather, this research is intended to identify issues portfolio managers should be aware of for them to assess their own opinion of positive or negative potential. The LMTR newsletter is NOT affiliated with any ETF’s. Active Alts is affiliated with Lamensdorf Market Timing Report. While LMTR uses charts from SentimenTrader, they do not have a financial arrangement with SentimenTrader Past performance is not indicative of future results.