Market Euphoria is Literally off the Charts

By John Del Vecchio and Brad Lamensdorf

Euphoria in the market is literally off the charts.

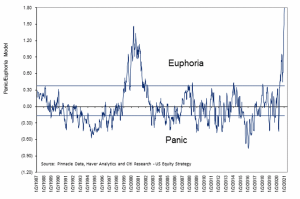

Here’s the Panic / Euphoria model from Citi below.

Not much else needs to be said other than it’s time to work into hedges.

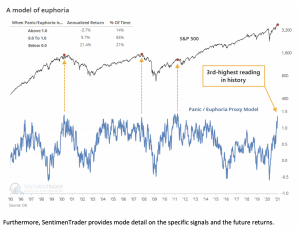

The team at SentimenTrader tried their hand at recreating the Citi model based on their understanding of the inputs that go into it.

While SentimenTrader’s version isn’t as extreme as the original Citi model, the result is close. When the SentimenTrader proxy is above 1.0 (Euphoria), which happens about 14% of the time, the annualized returns for the S&P 500 are -3.7%. Conversely when the model is below 0 (Panic), the market returns 21.4% annualized.

More importantly, based on this version, the market sits at the third most extreme level of euphoria in the last 30 years.

Market Euphoria is Literally off the ChartFurthermore, SentimenTrader provides mode detail on the specific signals and the future returns.

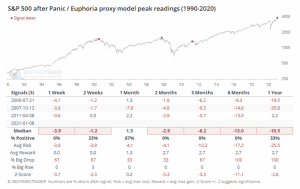

Market Euphoria is Literally off the ChartFurthermore, SentimenTrader provides mode detail on the specific signals and the future returns.

Market Euphoria is Literally off the Chart

Median returns tend to be negative across the board. Only 2011 was positive a year later, and barely so. This is even more reason to get active in hedging.

Active Alts has partnered with SentimenTrader to create proprietary signals that help inform the exposure in a long / short strategy. To learn more about how these models can help you mitigate risks in the market, book call with Brad.