Investor Sentiment Stock Market Indicators Continue to Flash Warning Signals

Investor Sentiment Indicators Continue to Flash Warning Signals. This past week’s investor stock market sentiment indicators are signaling that investors continue to be increasingly optimistic about stock market direction. Therfore, from a contrarian point of because the average investor has proven to be historically wrong about market direction, we once again suggest you take defensive action and lighten portfolios.

Short-term stock market indicators remain in overbought territory. The CNN Fear/Greed Index, which was at 67 two weeks ago, moved up to 72 this week and even closer to extremely greedy levels which often precede stock market declines. The Investors Intelligence Short-Term Composite Indicator at 80 was well into overbought levels. A reading over 70 means the market has become overbought.

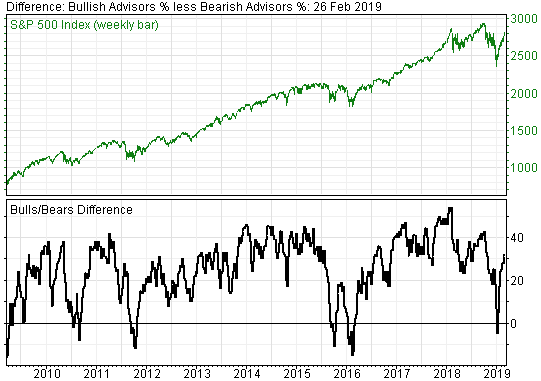

Intermediate term indicators have also continued to move higher into overly optimistic territory. Investors intelligence Bulls/Bears poll of stock market writer sentiment came in at 53% bulls and 21% bears. Indicating, a positive spread of 32, up from 31 the week before. Historically the spread between bullish and bearish sentiment has proven to be very useful in terms of market timing. The spread last December was a negative 5, meaning bears outnumbered bulls, just before the market bounced. A positive spread of plus 40, or higher, meaning bulls greatly outnumber bears, is very worrisome from a contrarian point of view.

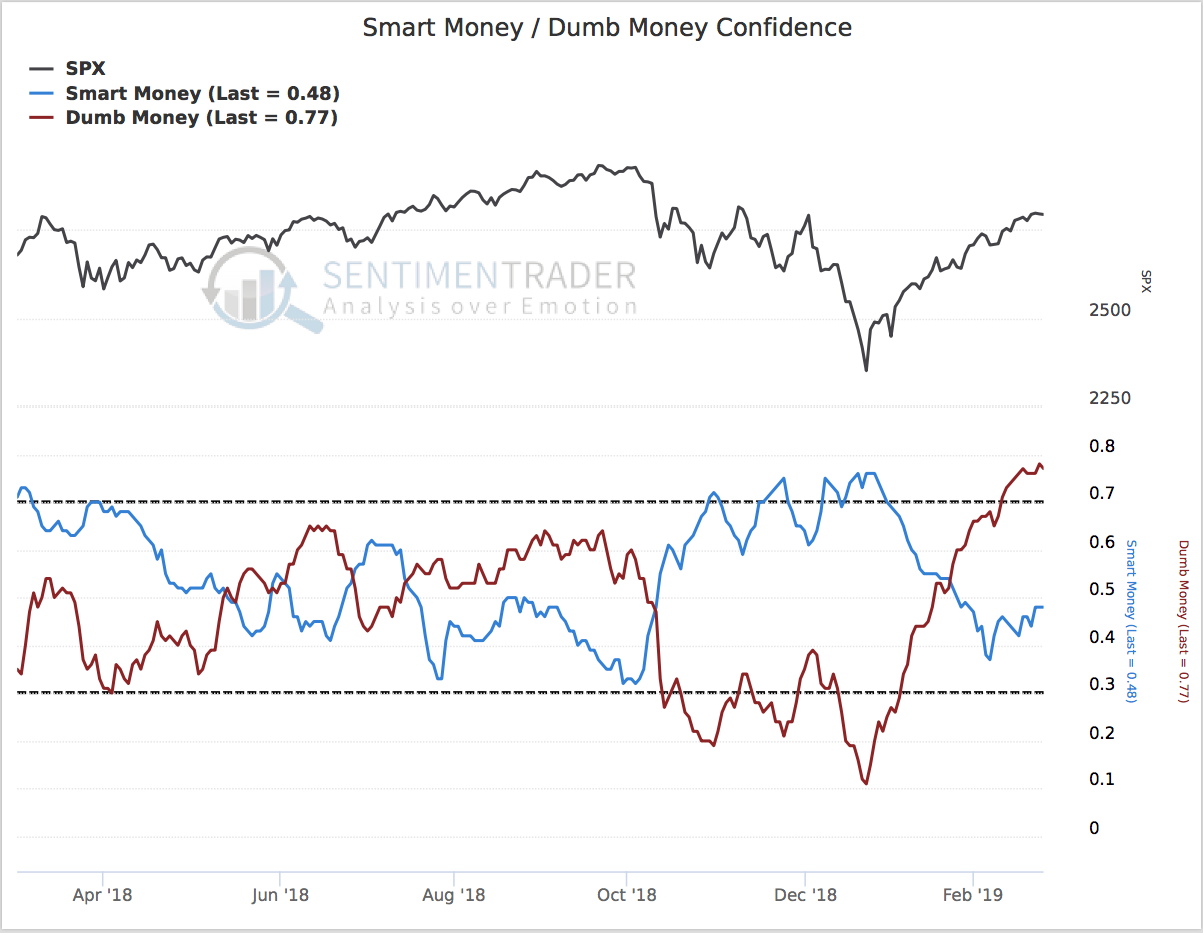

Another warning signal comes from SentimenTraders Smart Money Confidence and Dumb Money Confidence indices which allows investors to follow what good traders and bad traders are doing. The spread between smart and dumb traders continues to be unfavorable and bearish for the intermediate term. The spread also tells us to expect high volatility for the year.