Highly Irrational Investor Optimism Means Stock Market is Getting Very Scary

Highly Irrational Investor Optimism Means Stock Market is Getting Very Scary. We use investor sentiment as contrarian indicators of where the market is headed because historically investors are wrong. Recent market record highs have made investors so giddily optimistic they are ignoring underlying indicators of weakness, such as the lack of breadth propelling the market to record highs. (see Chart of the Week). In fact, recent days when the S&P 500 set records, more stocks went down than went up. So beware! The more the market reaches higher and higher overvalued levels, the further it will eventually tumble once reality sets in.

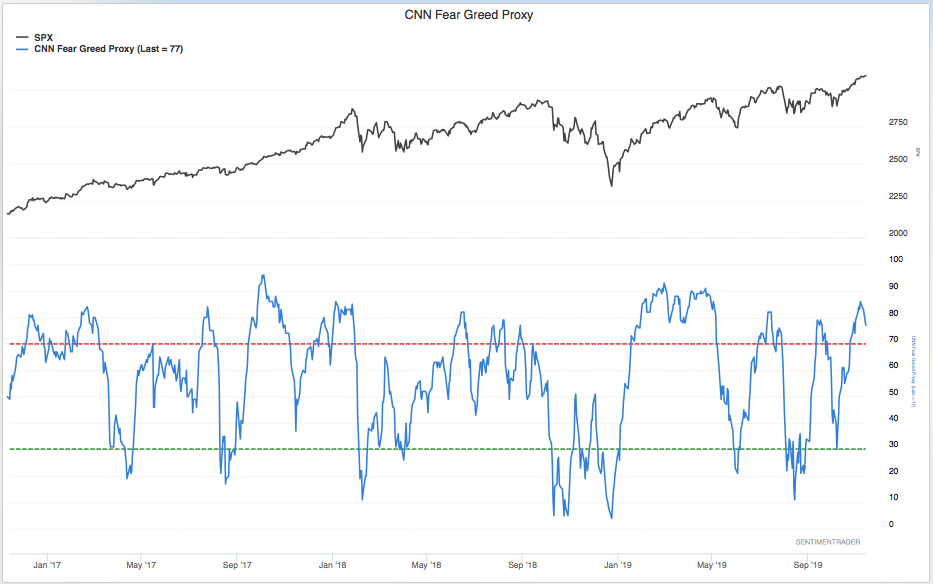

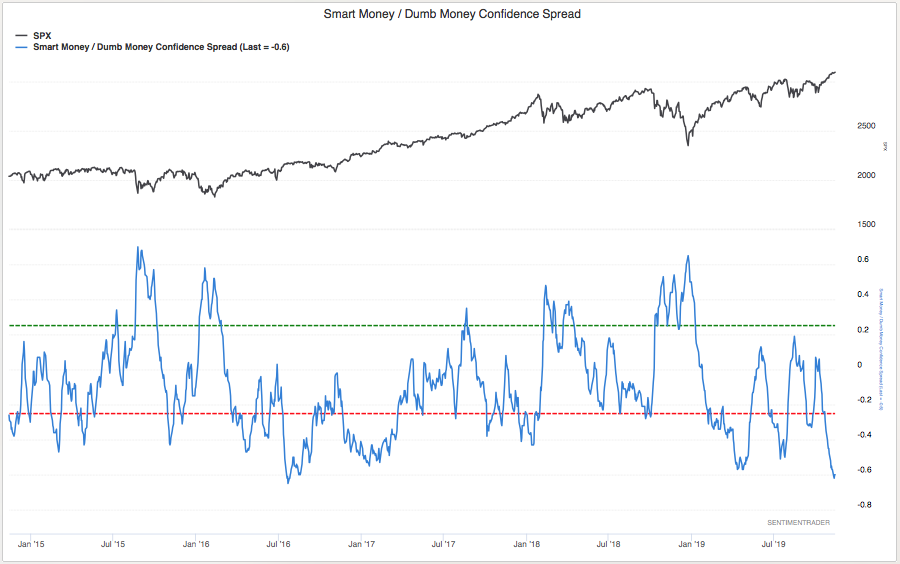

The CNN Fear/Greed, a good short-term contrarian indicator of market direction shows increasingly high investor greed. And as the chart below shows, high levels of greed are followed by market downturns. Another indicator that the market is on thin ice is the Smart Money/Dumb Money Confidence spread which compares trading by so-called smart and dumb investors. As the chart below shows the smart/dumb money spread has widened to a dangerous recent spread of – 0.6. Look at what happens in this chart to the S&P 500 market when the smart/dumb spreads have reached this kind of negative level.

Additional Caution:

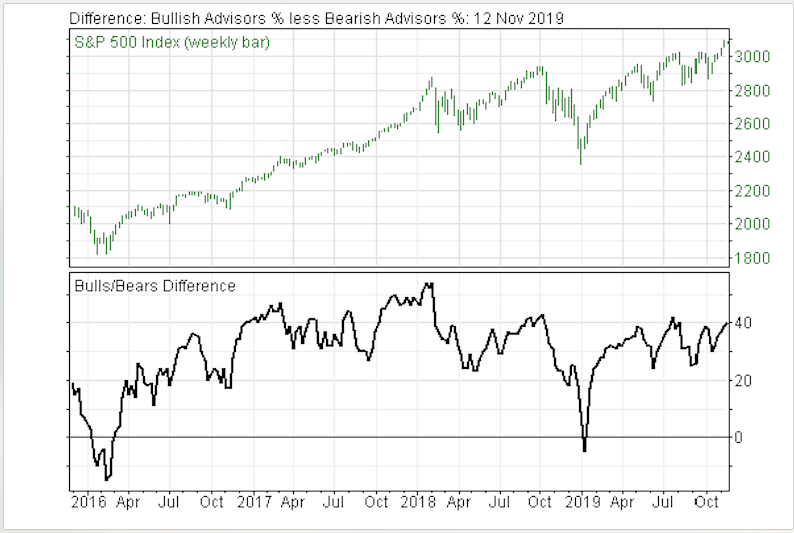

More caution comes from the Investor Intelligence survey of market newsletter writers. The bulls edged higher to 57.6% from 57.1% the previous week. Bullish sentiment above 55% calls for defensive action. Be aware that there was a sharp market downturn last August after bullish sentiment in this survey peaked at 58% in July. Meanwhile bearish sentiment was at 17.9% compared with 18% the previous week, yet another contrarian warning. Moreover, for the fifth week the spread between bullish and bearish sentiment expanded , ending at +39.7% compared with +39.0% a week ago (see chart). The bull/bears spread was +40% in late July just before the August downturn.

Conclusion: When high investor optimism ignores underlying market weakness, we get very concerned. And so should you.