Extremely Bullish Investor Sentiment on Stock Market Flashes Danger Signals

Extremely Bullish Investor Sentiment on Stock Market Flashes Danger Signals. We use investor sentiment as a contrarian indicator for stock market direction, and here’s why we are concerned. The Investor Intelligence poll of more than 100 newsletter writers reports bullish sentiment climbed this week to 58.9% from the previous 57.7%. That’s the highest level of bullish sentiment since the end of the summer 2018 when bullish sentiment exceeded 60%. And that preceded an October selloff in which the S&P 500 experienced its worst month since September 2011. Historically bullish sentiment above 55% is a signal investors take defensive measures, such as tight stops and possibly selling some shares with big gains, says John Gray of Investors Intelligence. Bullish sentiment over 60% signals even more danger.

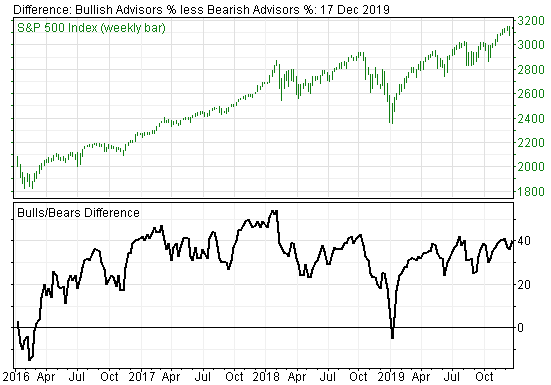

Meanwhile, bearish sentiment increased slightly to 17.8% from 17.3% two weeks before. The difference between bullish and bearish sentiment expanded the bull-bear spread to +41.1% compared with the previous +40.4% (see chart). A spread above 40% calls for defensive measures. Similar spreads last July preceded the August selloff. Another note of caution: The number of advisors projecting a correction dropped to 23.3% from 25.0%. “Readings below 25% are worrisome,” Gray also adds.