Despite Stock Market Downturn Investors Continue To Live in Fantasy World of Never-Ending Bull Market: Beware!

Despite Stock Market Downturn Investors Continue To Live in Fantasy World of Never-Ending Bull Market: Beware! We use investor sentiment indicators as contrarian gauges on the direction of the stock market. That’s because most investors historically make decisions detrimental to their financial well-being. The numerous sentiment indicators we follow overwhelmingly have been warning of an impending downturn as investors remain stubbornly optimistic. That’s despite all the historic warning signs that stocks are extremely overbought. Added to that is the present grave economic uncertainties which could cause a major market reversal.

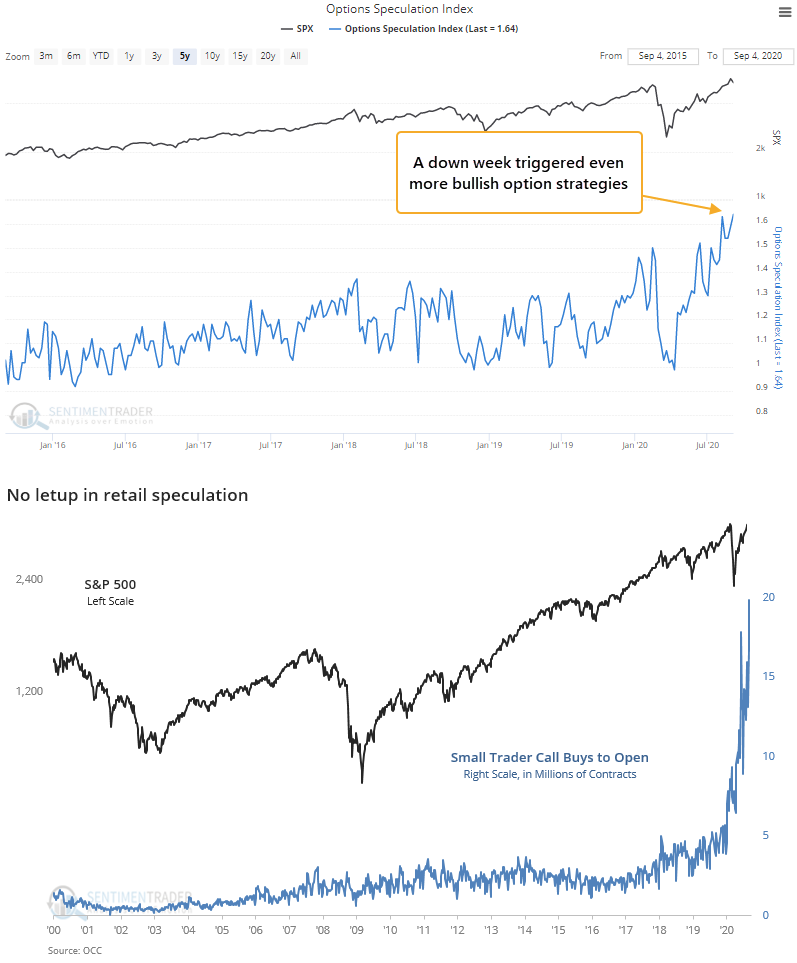

As you can see from the charts below, the recent downturn instead of rightfully instilling fear, has been treated by many investors as a ho-hum event that triggered an increase in bullish options strategies, including an increase in call volume. This foolhardy strategy leaves these investors unhedged and greatly exposed in the event of a downturn. And, it is yet another affirmation of our strategy as contrarians to move heavily into cash in our Active Alts SentimenTrader Long/Short portfolio. Which seeks superior long term appreciation while minimizing risk. Moving into cash preserves gains in stocks with considerable appreciation, gives us the ability to short weak stocks during a downturn, as well as buy stocks near the next bottom.