THE LMTR EDGE:

JOIN OVER 25,000 INVESTORS AND GET ALERTS FOR:

- Market Timing Reports

- Sentiment Updates

- Chart of the Week

- Weekly Podcasts

- The Magic Number - Top Stocks

Chart of the Week - 04/24/18

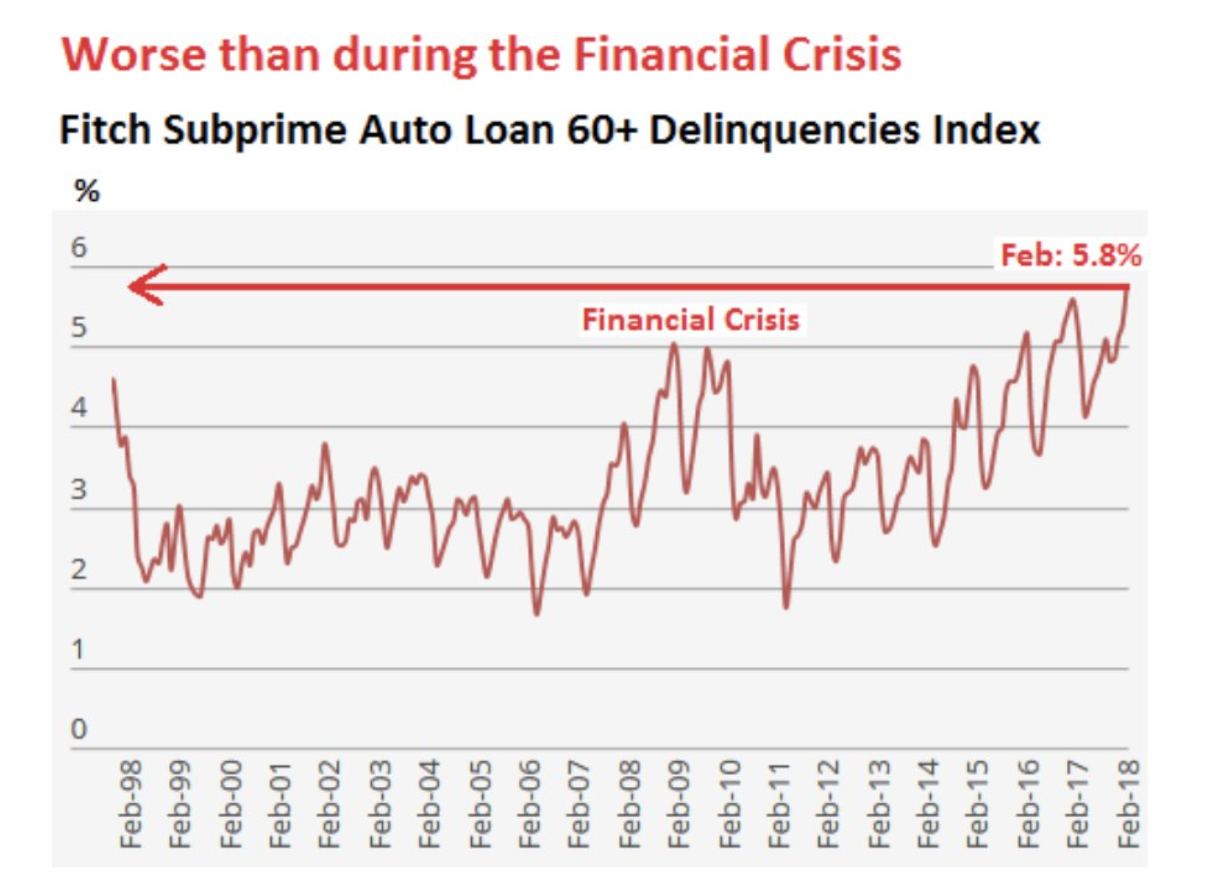

This Red Flag is Worse than the Financial Crisis

By John Del Vecchio

Subprime auto loan delinquencies are now higher than during the financial crisis in 2008-09. As you can see from the chart below, the 60+ day delinquencies rate for subprime auto loans has surged in recent years and is approaching 6%.

Looser credit standards might be to blame for the rise in delinquencies. Haven’t we seen this movie before with mortgage lending standards? That’s right, it was a horror film that ended badly and resulted in trillions of dollars in bailouts.

Any Joe Schmoe could buy a house well beyond his means? You make $35,000 in a retail job? No problem, here’s a $700,000 house. All you have to do is sign on the dotted line and take out an equity loan on an asset you have no equity in.

Human nature is a funny thing. It never changes. We are right back to the loose lending standards that we experienced years ago. It’s like the lesson of tremendous pain was never learned.

This crisis might not be as bad as the housing crisis in that autos are not quite the big-ticket expense as a house. However, if your car is repossessed, you might have trouble showing up for work.

The trend in delinquencies does indicate that a portion of the consumer market is feeling some pain. They’re being left behind in the “recovery”. Of course, government statistics such as the unemployment rate use a lot of adjustments and, in the end, are just made up numbers.

The risk is that this starts to spread. Initial pain by the weakest credits could creep up the latter. Eventually companies will feel the pinch and we will start to see this pain show up in other parts of the economy.